In this article we'll share some useful hints and tips to help manage your caseload efficiently.

With lots of cases to manage and keep constantly updated, staying organised is key.

Here are our top tips and tricks to help make managing your caseload easier using the Exizent platform:

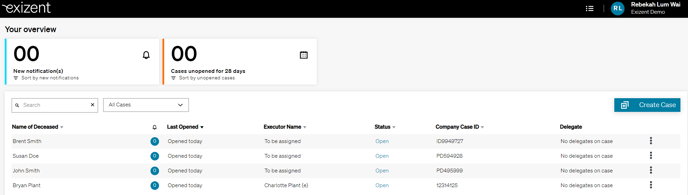

- Focus on your own open cases

Click on the menu in the top right-hand corner beside your profile icon to navigate to the Your overview page. Use the dropdown menu and filter to Open to see a list of all your open cases. - Use the search function in Your overview to quickly access individual cases

In the Search bar, type in the name of the deceased, lead executor or your company case ID to find the case you're looking for quickly. - Keep track of when you last worked on each case to minimise delays for your clients

Use the Cases unopened for 28 days tally and the Last Opened column on the Your Overview page to keep track of when you last worked on each case. - Add users with Delegate permissions to cases you need extra help with

On the Your Overview page, click the 3 dots at the end of the row that shows your case, select Add delegate, then choose the colleague you want to help you. - When your caseload is high, consider reassigning cases to other users

On the Your Overview page, click on the 3 dots at the end of the row that shows your case, select Change case owner then, select the colleague you would like to reassign your case to.

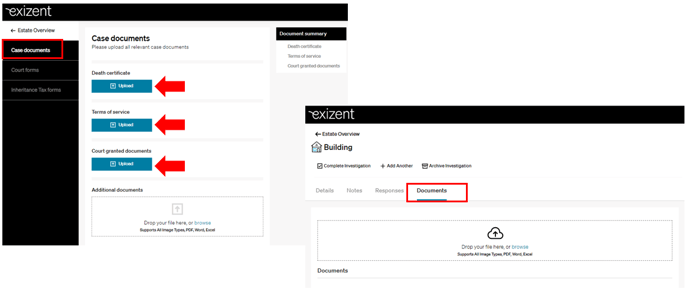

- Store key documents for each case in a central location or against the relevant asset

Neatly organise and store key documents like the Death certificate or Terms of service in the Case Documents section of the Documents and Forms area within the case. Key documents relating to specific assets can be stored in the Documents tab for each asset — making it easy for you and your colleagues helping you with the case to find documents quickly and easily.

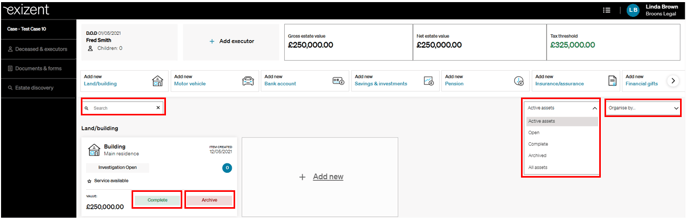

- Track the investigation status for each asset in your case dashboard

Use the Complete and Archive buttons on each asset tile to keep track of which assets you are still investigating. The green Investigation Complete labels let you see your progress with each asset at a glance. -

Prioritise assets where further data gathering is required Use the dropdown menu to filter to Open and only show assets you are still investigating to focus your workload on the important items.

- Use the search function in your case dashboard to quickly access and update assets

In the Search bar of your Case Dashboard type in details about the asset you're looking for to find and update it quickly. For example, type in the name of the bank to get a quick list of any assets you have logged for the deceased with that bank to update confirmed balances.

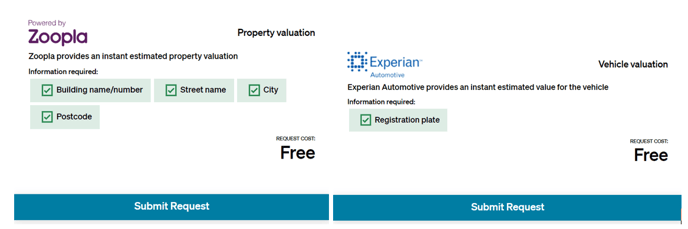

- Use the Zoopla and Experian Automotive valuation checkers to quickly sanity check values for properties and motor vehicles

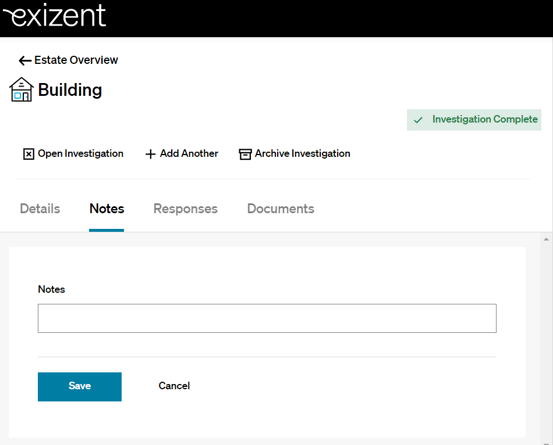

Enter basic details about the property or motor vehicle then use the Submit Request button to request valuations. Ahead of getting formal valuations, this helps give a quick indication of asset values and the overall estate value to help guide your discussions on whether inheritance tax may be payable on the estate. - Use the notes tab on each asset to store useful additional information

Key notes relating to specific assets can be stored in the Notes tab for each asset making it easy for you and your colleagues to keep track of key updates and information.

-

Use the Forms functionality to reduce data re-entry and save time

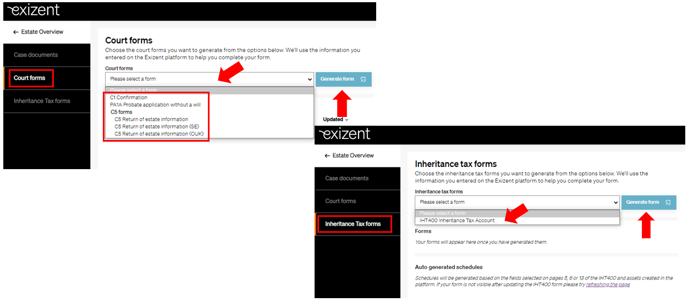

In your case:- click the Documents & forms button

.png?width=174&name=20220811%20Documents%20and%20Forms%20outline%20(Menu).png)

-

Then, select Court forms or Inheritance Tax forms. In the dropdown menu, select the form you need and click to Generate Form. For key court forms like the C1 or the PA1A/P, the platform will prefill the majority of the values based on the data you have already entered in the case.

-

IHT205 forms have over 85% of the values prefilled from information already entered in the case.

-

IHT400 and Schedules - A high proportion of the IHT400 is pre-filled from case data. Values entered into the schedules are also automatically pulled through to the IHT400. All schedules are available and can be generated by either selecting on the IHT400 form itself, or they will be generated automatically via asset entry on the platform eg. an IHT409 will generate if a Pension asset is added. To see our full form functionality please visit: How do I prepare an IHT400 and relevant schedules?

- click the Documents & forms button

-

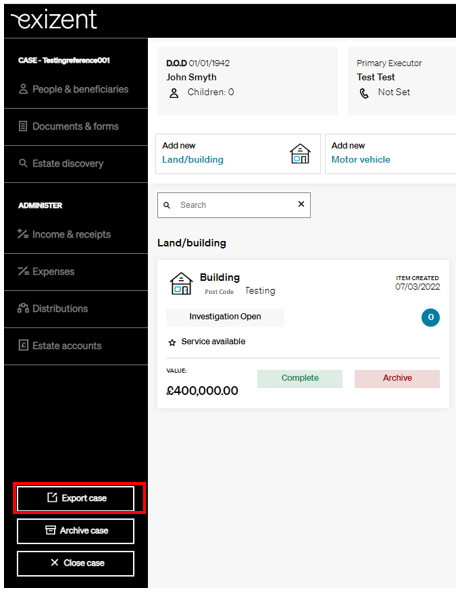

Use the Export Case feature for help with calculations, estate accounts preparation and client updates In your case, click the Export Case button then Export to download a list of all the assets and liabilities entered in your case to an Excel spreadsheet. You can use this feature at any point to get an overall summary of the estate in Excel to help with updates during client calls or, towards the end of your case when completing inheritance tax calculations.

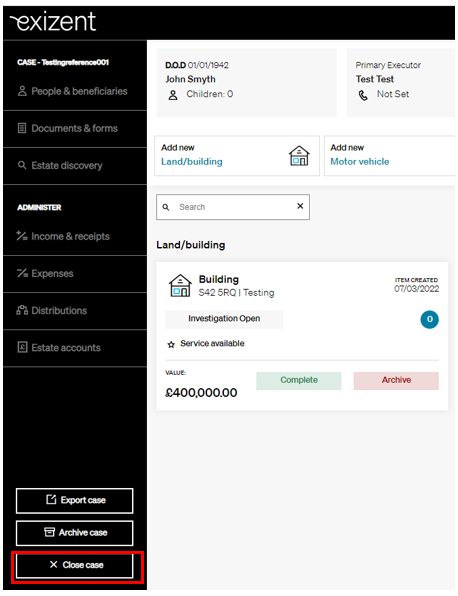

- Close your cases when all matters have been dealt with

In your case, use the Close Case button to complete your case when all matters relating to the estate have been dealt with. This will mean you can easily filter to open cases only, focusing your work on the important cases at hand.

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help.

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com