How do I prepare an IHT421 form?

This article will guide you on how to generate an IHT421 form (probate summary) on your case

How to generate the IHT421

- Open the IHT400 - How do I prepare an IHT400 form?

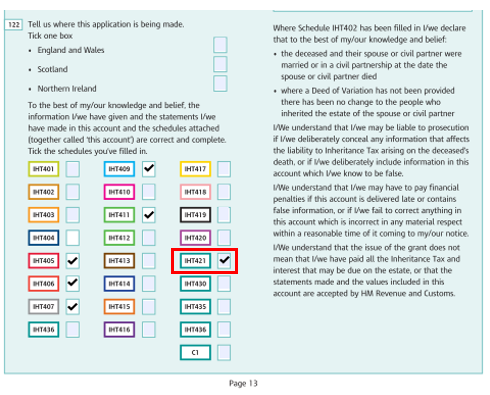

- On page 13, tick the IHT421 then Save & close the IHT400

- The IHT421 will now display in the Inheritance tax forms area

- A large amount of the IHT421 is pre-populated with information you have already entered into your case on the platform, saving you lots of time not having to re-key data

- Click into the IHT421 and enter any further information

- Click Save & close

💡 White fields on the IHT421 are not editable. This is because they are pre-populated with either information entered into your case on the platform or with values/totals from corresponding schedules and calculations

❗ To edit information in white fields you must go to where you originally entered the data, update the information and save. When you re-open your IHT421 the information will have automatically updated. For example, if you have misspelt the deceased's name, go back to your Estate overview, click into the deceased's details, update the name with the correct spelling and click Save. Go back and open the IHT421 to see the correct spelling displayed

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com