How do I prepare the reduced rate of Inheritance Tax IHT430 schedule?

Let us guide you through how to generate the IHT430 through the platform

How to generate the IHT430

- Open the IHT400 - How do I prepare an IHT400 form?

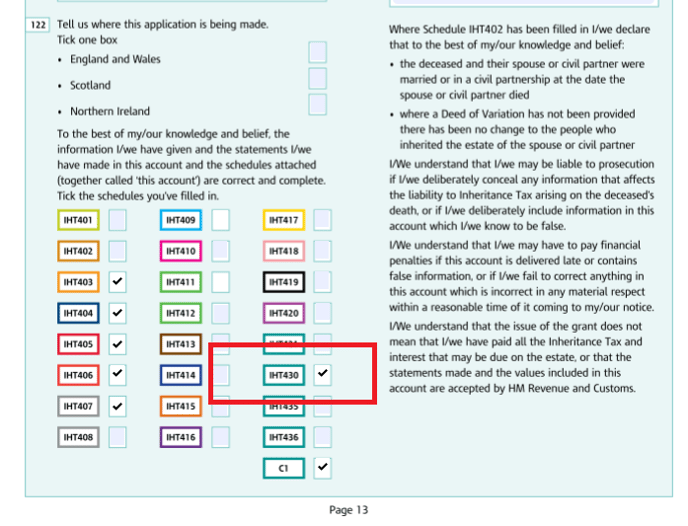

- On page 13, tick the IHT430 then Save & close the IHT400

- The IHT430 will now display in the Inheritance tax forms area

- Click into the IHT430 and enter further information in to any grey field

- Click Save & close

💡 White fields on the IHT430 are not editable. This is because they are pre-populated with information entered into your case on the platform

💁 Grey fields on the IHT430 are editable and you can enter/edit information and save as you go

❗ To edit information in white fields you must go to where you originally entered the data, update the information and save. When you re-open the IHT430 the information will have automatically updated

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com