How do I prepare an IHT403 form?

This article explains how to prepare an IHT403 (gifts and other transfers of value) schedule in your case

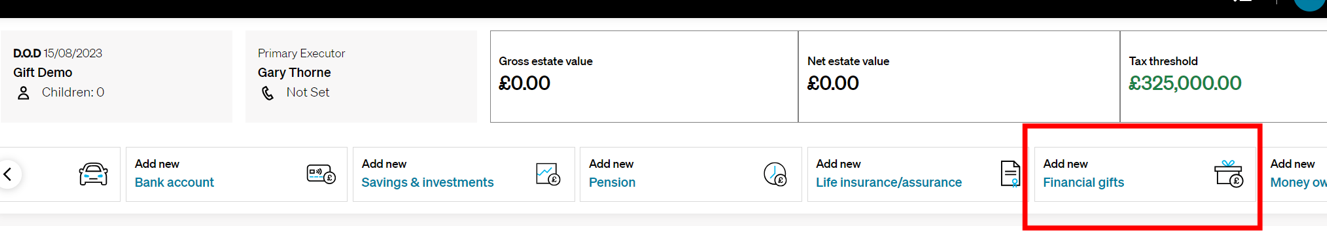

Adding Financial gifts to your case

- Navigate to the Estate Overview page in your case and click to add new Financial gifts

- Enter all relevant information into the Gift information, Gift value and Additional information sections

- In the Type of gift field, the category you choose will determine which section of the IHT403 the gift is recorded in:

- In the Recipient’s relationship to deceased field, you are able to pick from a range of relationships which will then be recorded in the IHT403:

- If you choose Charity or Organisation, the field options will change slightly to require only Recipient:

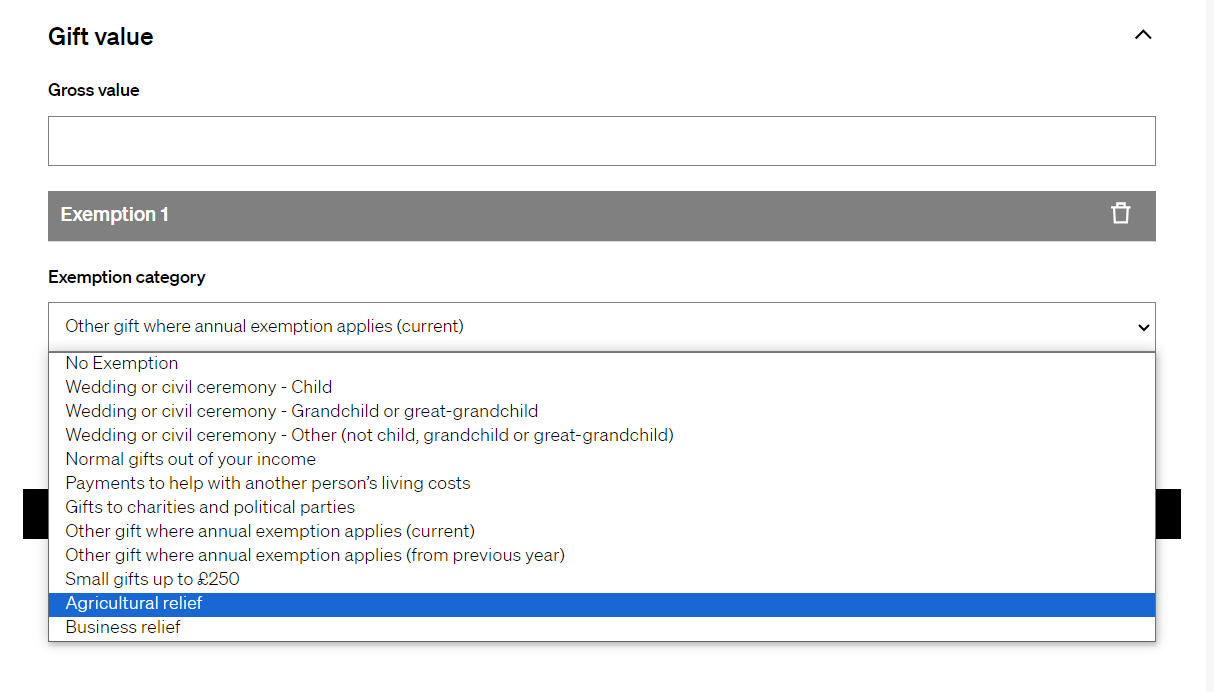

- In the Gift value section, select a relevant exemption category if an exemption is being applied to the gift and this will be recorded in the Type of exemption or relief column in the IHT403:

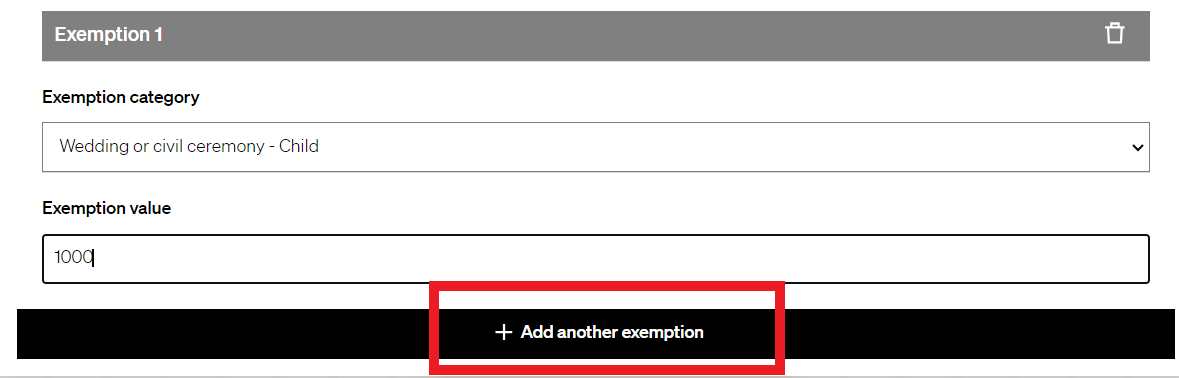

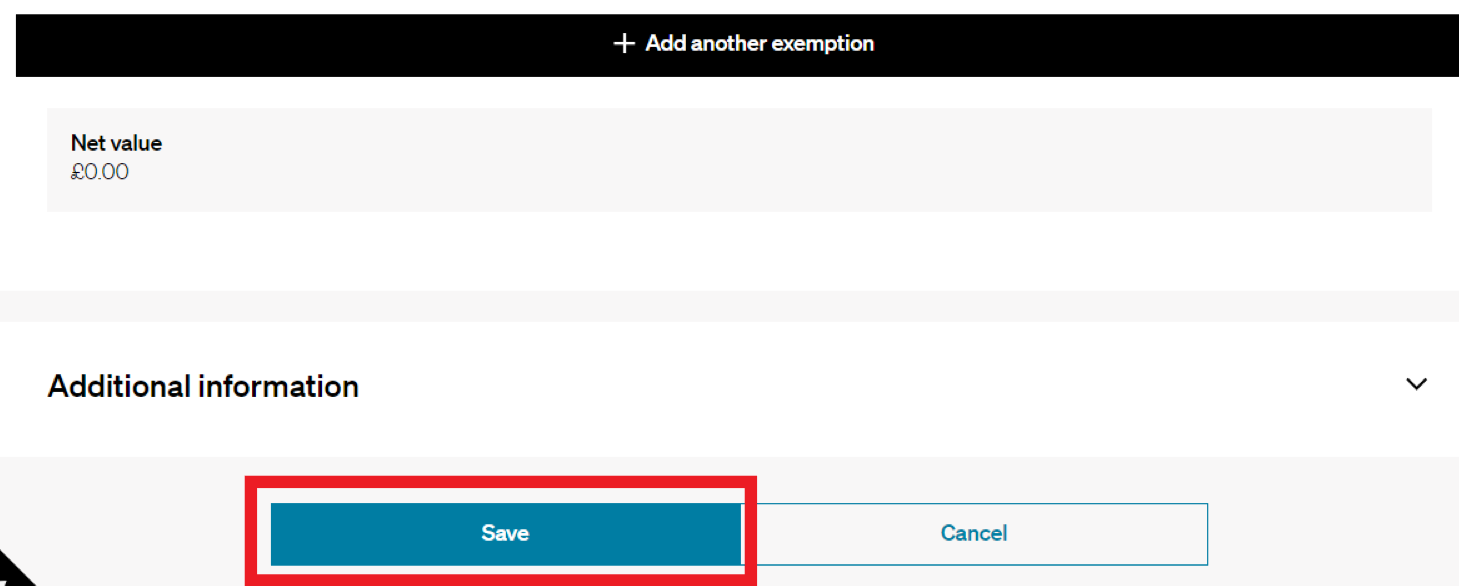

- If you have more than one exemption to apply to the gift, you can simply click the + Add another exemption button, enter the details and click Save at the bottom of the page when you have finished adding each exemption

- Details of the multiple exemption categories being applied to the gift will be recorded in the Type of exemption or relief column in the IHT403

Creating an IHT403 schedule

- If you have already generated an IHT400 on the case, go to Documents & forms > Inheritance Tax forms and you will see the IHT403 within this section

- If you have not generated an IHT400, please navigate to this section and choose the IHT400 Inheritance Tax Account and click Generate. Please see How do I prepare an IHT400 form and schedules

- On page 5 of the IH400 form, you will see Yes ticked against question 30 Gifts and other transfers of value

- Click Save & close

- In the Inheritance Tax Forms page an IHT403 will appear in your list of forms:

🙋♀️ Please see here for more detailed guidance on how to generate an IHT400 and relevant schedules

👍 If you have already generated an IHT400, no need to generate again. Once you add Financial gifts, you will see an IHT403 form automatically generates within the Inheritance Tax forms section

⭐ If there isn't enough space on one IHT403 form, the platform will automatically generate multiple IHT403 gift schedules to capture all the gift details entered in your case and will total up the values required for the IHT400 for you

Reviewing the IHT403 form

- Click on the IHT403 form to open it

💡 You will see some fields in the schedule are grey and some are white. Grey fields require a manual update and white fields are prepopulated with the gift information you have added to your case

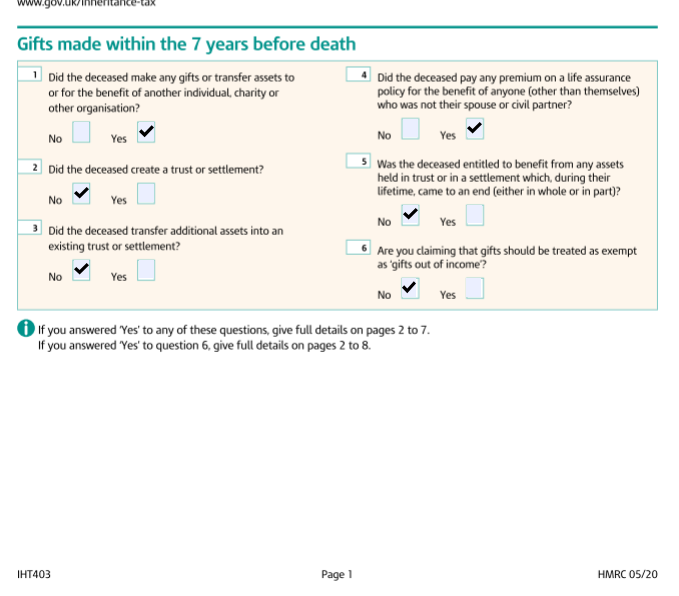

- Please manually update any grey fields, for example page 1 requires you to tick the relevant boxes:

- You can check over any prepopulated information in the white fields:

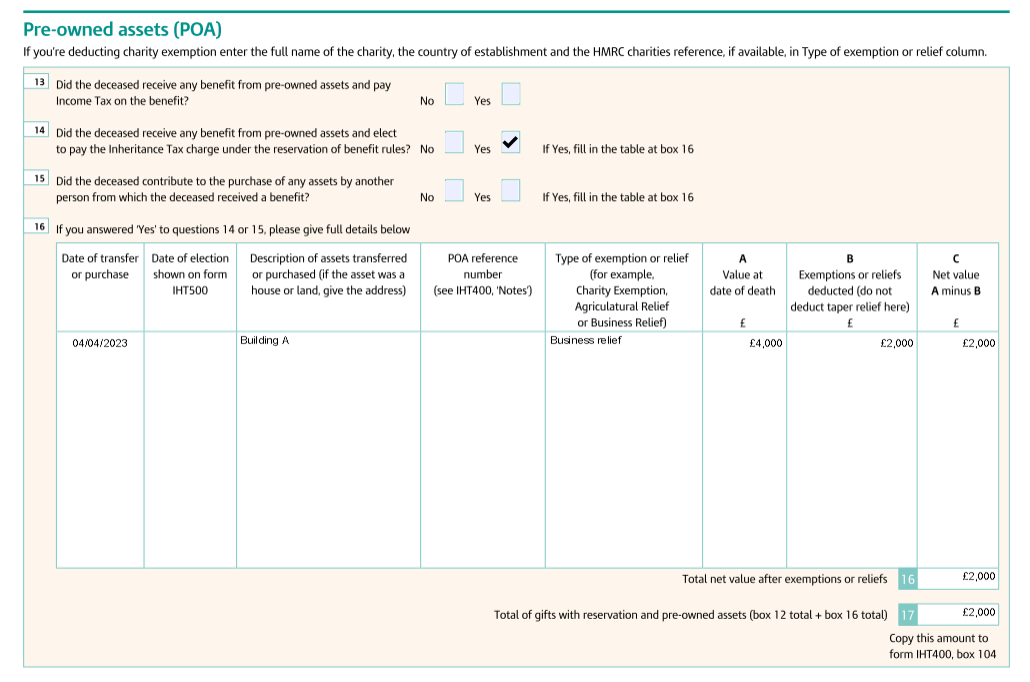

⭐ The Total net value after exemptions or reliefs value in box 7 will prepopulate box 113 of the IHT400

⭐The Total of gifts with reservation and pre-owned assets value in box 17 will prepopulate box 104 of the IHT400👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com