How do I prepare an IHT418 schedule?

A step by step guide on how to prepare an IHT418 schedule (assets held in trust)

Use the below links to access guidance needed:

Where to find the asset

How to add Interest in possession

How to add Future right to assets

How the asset appears on the IHT418

👍 An IHT418 schedule will generate automatically once you add an Assets held in trust item to your case

Where to find the asset

- On Estate overview, look along the asset and liability ribbon and click on Assets held in trust

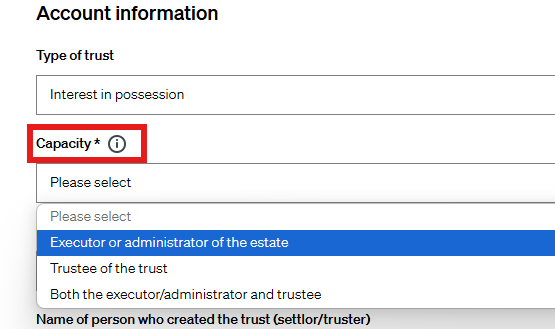

- Once open, choose Type of trust from the drop down menu

- Select the Capacity from the dropdown - this will determine which areas of the IHT418 will be populated

💁 If Executor or Administrator of the estate is selected, sections D and I of the IHT418 will be completed and the trustees of the trust must complete an IHT100b

⭐ If Trustee of the trust or Both the executor/administrator and trustee is selected, sections E, F, G, H and I of the IHT418 will be completed

Interest in possession

- Enter all relevant details in to the Account information section ensuring the correct Capacity is selected

- Enter relevant information in to Trustees and solicitors details

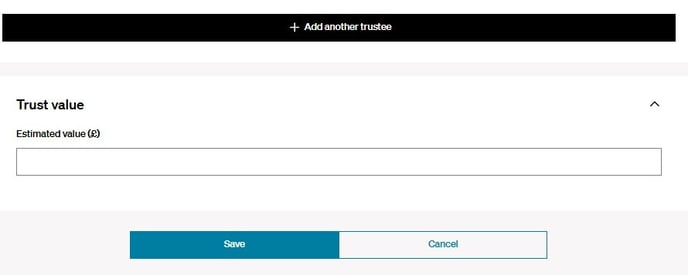

- Enter relevant information into Trustee details, if you need to add another Trustee click on Add another trustee button until you've entered all details necessary

- Within the Trust value section, choose Yes if you have the details of the assets

-

Two sections will appear, the first section is Properties, businesses and controlling shares details and the second section is Other asset details. Click on the information icons

to find out more about what type of assets should go in to these sections.

to find out more about what type of assets should go in to these sections. - For Properties, businesses and controlling shares details select the Asset Type from the dropdown

ℹ️ Include details for assets held in trust, such as:

- Houses, land or buildings

- Businesses or business interests

- Shares and securities which gave the deceased control over the company

- Enter the description and value and if you have more, keep clicking the Add another trust asset button until you've entered all details necessary

- For Other assets details select the Asset Type from the dropdown

ℹ️ Include details of all other trust assets not previously listed, such as:

- Bank accounts

- Quoted shares which did not give the deceased control over the company

- Enter the description and value and if you have more, keep clicking the Add another trust asset button until you've entered all details necessary

If you don't have details of all the assets in the trust and their values, choose No:

- Enter the Total value

- If tax is being paid now choose Yes, if it is being paid later choose No

💁 You'll see a running total value of the assets underneath the Trust asset information

- If there are any liabilities, exemptions or reliefs to be deducted from these assets choose Yes, if there aren't choose No

- If you have chosen Yes to say there is a liability, enter the Name of creditor, Description and Value and if you have more, keep clicking the Add another trust liability button until you've entered all details necessary

- If you have chosen Yes to say there are exemptions, choose Exemption type, add the Exemption value and if you have more, keep clicking the Add another trust exemption button until you've entered all details necessary

- The Total assets held in trust value is calculated at the bottom

- Click Save

Future right to assets

- Enter all relevant details in to the Account information section ensuring the correct Capacity is selected

- Ensure that the Name of the person who is receiving the benefit is recorded in the appropriate field

- Ensure that the Age of the person who is receiving the benefit is recorded in the appropriate field

- Add an Estimated value in to the Trust value section and click Save

How the asset appears on the IHT418

⭐ When you generate an IHT400, the IHT418(s) will generate automatically based on the information you have entered in to the asset. For more information on how to generate the IHT400 and schedules, please see here

⭐ Interest in possession and Future right to asset items will generate on to separate IHT418 schedules

- We will populated the form dependent on how you have entered information into your Trust Asset, the Type of Trust and the Capacity. There will still be some areas of the form that require to be completed manually and these will be in a grey box and editable.

- Below is an example of how the IHT418 schedule will be populated when the trust type is Interest in possession with capacity of Executor or Administrator of the estate

⚡ All relevant information and values will automatically update in to the IHT400. To make any changes to the information held in this schedule, please update the information within the asset, save and then reopen the IHT418 to refresh the information. For more guidance around this, please see here

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com