How do I prepare an IHT435 form?

This article explains how to prepare an IHT435 schedule when claiming the residence nil rate band in your case

Create the asset the residence nil rate band is being claimed on

- Add the building or land the residence nil rate band is being claimed on as an asset in the case - See adding assets and liabilities

- In Ownership information, answer Yes to Will you be claiming residence nil rate band on this residence?

💁 Hover over the (i) for further information

- Select the correct Proprietorship

- Add the relevant valuation for the asset

- Once you save this asset, remember to add any mortgages or secured loans associated with it. When you add the debt, you'll see a Debt secured against field. When selecting this field, a dropdown menu of assets will appear, please ensure to choose this asset in order to link them:

Creating an IHT435 schedule

- Go to Documents & forms > Inheritance Tax forms and select IHT400 from the dropdown menu then click Generate form. Please see How do I prepare an IHT400 form and schedules

- On page 5 of the IH400 form, tick Yes against question 29a Residence nil rate band

- Click Save & close

- In the Inheritance Tax Forms page an IHT435 will appear in your list of forms

Populating the IHT435

- Navigate to Documents & forms > Inheritance Tax forms

- Click the IHT435 form in the list to open it

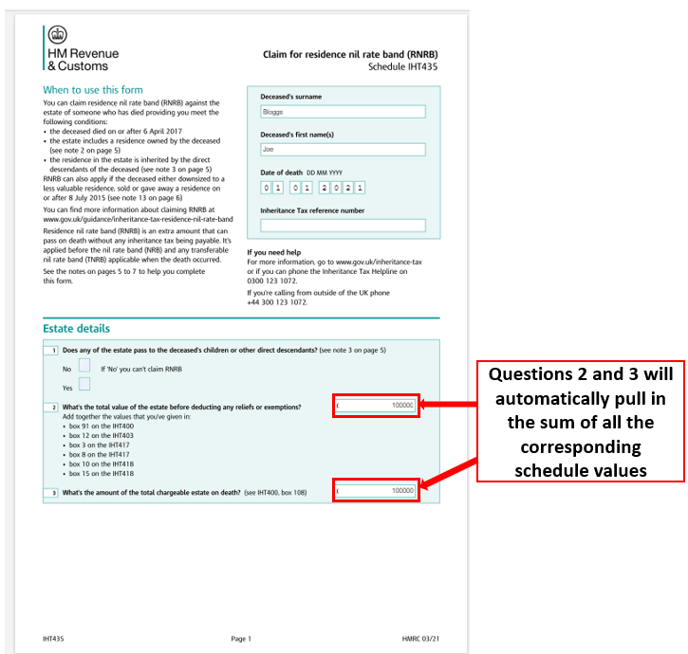

💡 For the auto-populated fields in the IHT435:

- Questions 2 and 3 will automatically pull in the sum of all the corresponding schedule values

- Question 4 will be ticked Yes if you have added a building and answered Yes to Will you be claiming residence nil rate band on this residence?

- Question 5 will show the address the residence nil rate band is being claimed against - this will only be for a building and not land

- Question 6 will show the value of the asset the residence nil rate band is being claimed against less any linked liabilities

- Question 13 will be ticked if you have already ticked Yes against question 29b Transfer of unused residence nil rate band in the IHT400 form in your case

- Question 14 will show the corresponding value from box 15 or 22 if you have already ticked Yes against question 29b Transfer of unused residence nil rate band in the IHT400 form and added the relevant values in an IHT436 form in your case

- Review the form and enter any further relevant data in the grey editable fields

- Save and close the IHT435 form to save your changes

💡 If you don't see data as expected in boxes 13 and 14 on the IHT435 you should complete an IHT436 form as required

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com