How do I prepare an IHT400 form and the relevant schedules?

This article features videos and a step by step guide to help you understand how to generate an IHT400 and the schedules you need.

When preparing an IHT400, some of the schedules will generate automatically based on assets you have entered in to your case and the values from these schedules will then populate the IHT400. All other schedules should be chosen manually from within the IHT400 form and once completed, their values will also pre-populate the IHT400. To find out more, please watch the below videos or follow the step by step guide.

- List of autogenerated schedules

- Video: How to generate and edit the IHT400

- Video: How to generate autogenerated schedules

- Video: How to generate manual schedules

- Video: Forms Housekeeping

- Step by step guide

Video: How to generate and edit the IHT400

Length: 3 Minutes 35 Seconds

Video: How to generate autogenerated schedules

Length: 3 Minutes 8 seconds

Video: How to generate manual schedules

Length: 1 Minute 46 seconds

Video: Forms Housekeeping

Length: 2 minutes 10 seconds

💁 The schedules we currently auto-generate and pre-populate based on the asset information you enter into the platform are:

- IHT403 Gifts and other transfers of value

- IHT404 Jointly owned assets

- IHT405 Houses, land, buildings and interests in land

- IHT406 Bank and building society accounts

- IHT407 Household and personal goods

- IHT409 Pensions

- IHT411 Listed stocks and shares

- IHT418 Assets held in trust

- IHT423 Direct Payment Schemes for Inheritance Tax (IHT423)

👋 We also pre-populate data in the schedules below when ticked in the IHT400 form:

- IHT421 Probate summary (reflective of the HMRC changes as of Jan '24, this is now for Northern Ireland matters, more information on the changes can be found here)

- IHT402 Transfer of unused nil rate band

- IHT435 Residence nil rate band

- IHT436 Transfer of unused residence nil rate band

Currently, all other schedules should be chosen from within the main IHT400 form and once completed, their values/totals will also pre-populate the IHT400. To find out more, please watch the above videos or follow the step by step guide below

Step by step guide

❗ In order to generate an IHT400 you must create a case, add the Executor(s) and add at least one asset to your case

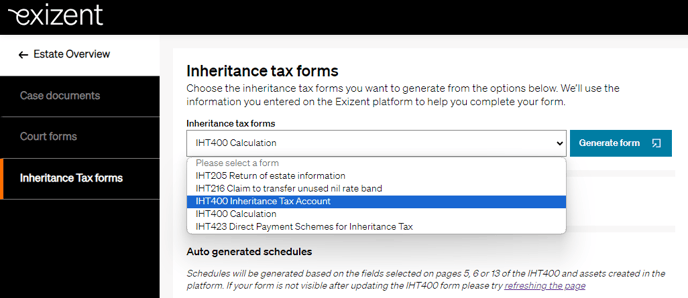

- On the left hand side menu bar of your Estate overview, choose Documents & forms and click into Inheritance Tax forms

.png?width=174&name=20220811%20Documents%20and%20Forms%20outline%20(Menu).png)

- Pick the IHT400 from the drop down and click Generate form

- Once opened, you'll see that a large amount of the IHT400 is pre-populated with information you have already entered into your case on the platform, saving you lots of time not having to re-key data

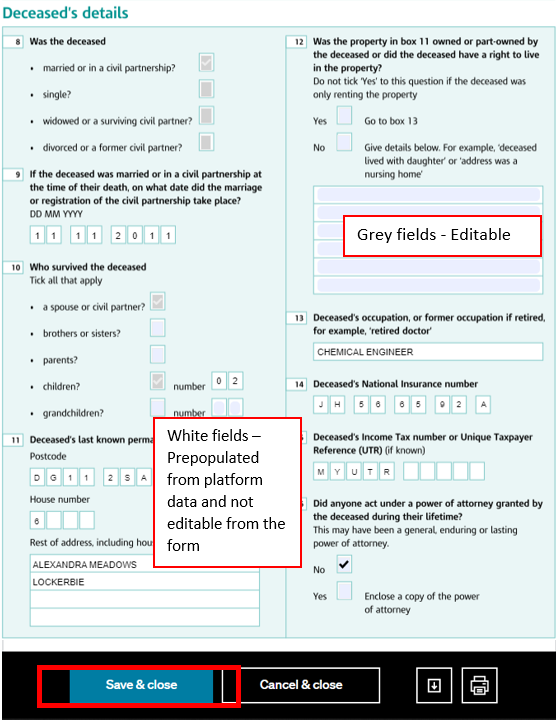

💡 White fields on the IHT400 are not editable. This is because they are pre-populated with either information entered into your case on the platform or with values/totals from corresponding schedules and calculations

To edit information in white fields you must go to where you originally entered the data, update the information and save. When you re-open your IHT400 the information will have automatically updated. For example, if you have misspelt the deceased's name, go back to your Estate overview, click into the deceased's details, update the name with the correct spelling and click Save. Go back and open the IHT400 to see the correct spelling displayed

💡 Grey fields are editable

- To edit information in grey fields simply update the information on the form as necessary. Be sure to save as you go by clicking Save & close

How to generate schedules

💁 There are currently two ways of generating schedules within the platform. One way is autogenerating schedules based on assets you have entered in to your case and for any schedules that are not currently autogenerated, the second way is manually selecting these by ticking them within the IHT400 form.

❗ Please see the information box above for up to date details on which schedules auto-generate

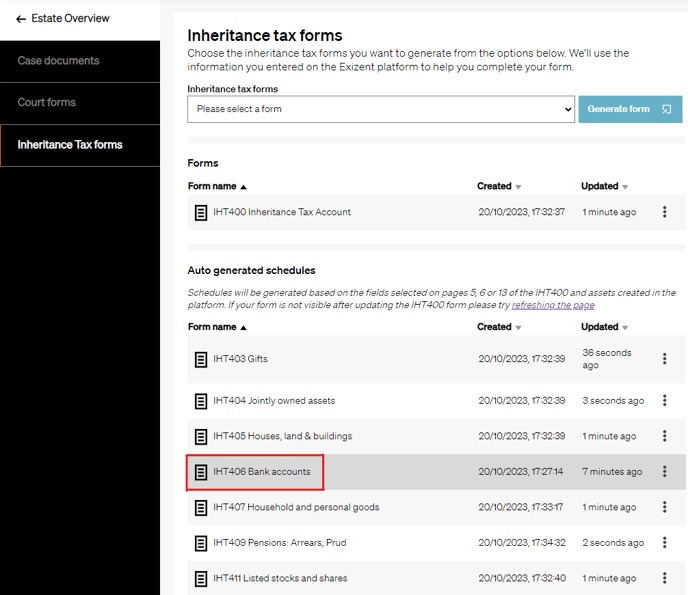

Auto-generated schedules

- For an example of an auto-generated schedule, click back in to Estate overview and add a sole bank account asset. Complete the information and Save

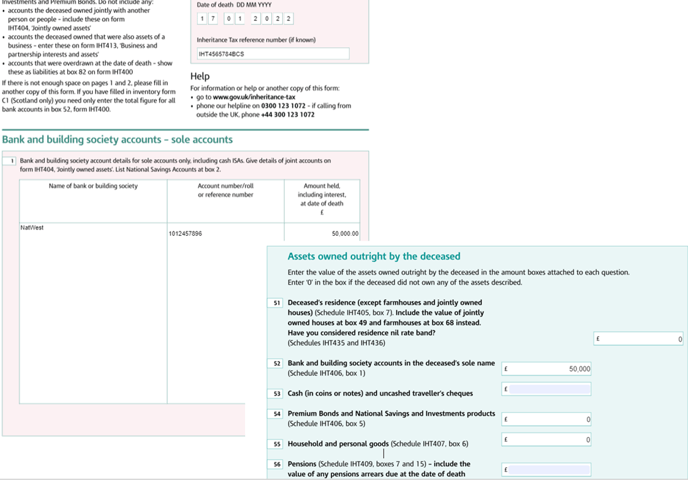

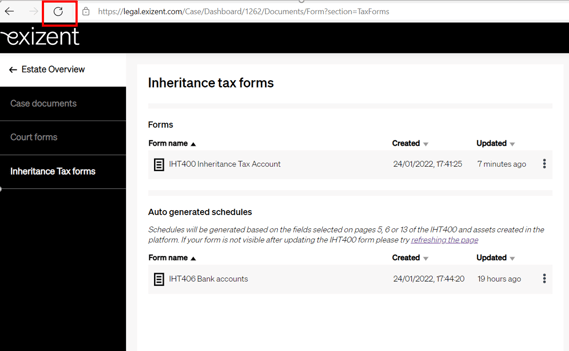

- Go back to Inheritance Tax forms. You will now see the IHT406 Bank accounts schedule is in the overview

- Open the schedule to see the asset information you entered pre-populated into the IHT406

- Open the main IHT400 and you will see the values from the IHT406 have pre-populated into the relevant fields

How to generate all other schedules

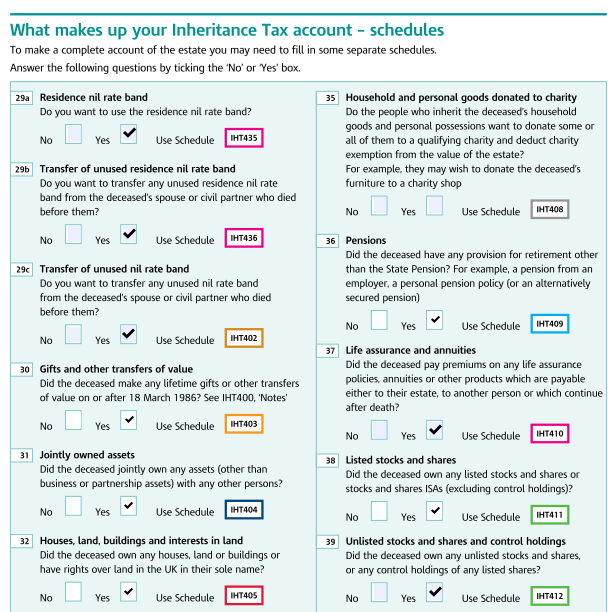

- Open the IHT400

- On pages 5 & 6 or 13, tick the schedules you require and then click Save & close

- On the overview section click the refresh button

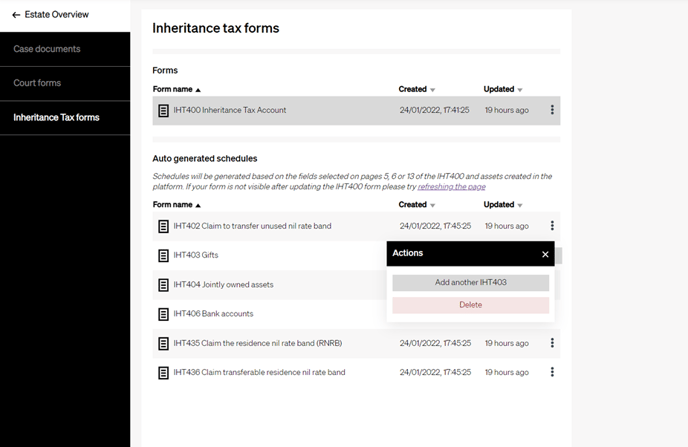

- You will now see your chosen schedules in the overview

- Click into a schedule

- Enter the information needed

- Click Save & close

- Open up the IHT400 and you will see totals and values from these manually completed schedules will pre-populate into relevant fields

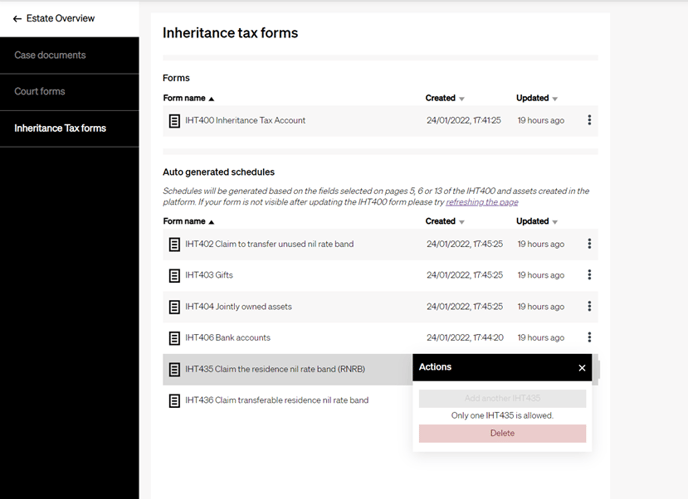

Your forms and schedules are saved in the overview section. From here you can:

- Select any other additional IHT forms or corrective accounts forms

- See the Actions menu of a schedule or form by clicking on the three dots to the right

- Delete schedules that are not generated from asset information

- Add another IHTXXX schedule to manual schedules if you need to complete multiples of the same schedule

💁 To delete an autogenerated schedule, simply delete the corresponding asset(s) and it will automatically delete the schedule

💁 If there are lots of items on an autogenerated schedule, it will automatically create another schedule if more space is needed

- You can open, view, edit and update any of your forms and schedules from this overview section whenever necessary

- Once you have completed all the required information in the IHT400 form and the relevant schedules, you can do a final review of your form and print it off ready for signatures

👍 The IHT400 form and schedules will remain stored in your Inheritance Tax forms tab so you can access them at any time

👍 The platform populates the IHT400 form and schedules with the most up to date case information every time you open a form so you can have confidence the form is always up-to-date

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com