How do I add overseas assets to my case?

This article will guide you through how to add overseas assets to your case and provide some useful hints and tips.

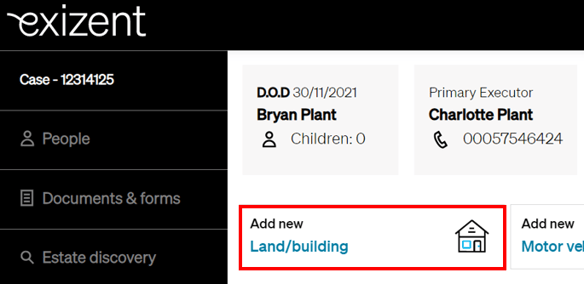

In the case you are working on:

- Click the asset tile you want to add. As an example, we are using a holiday home in Spain therefore adding a new Land/building asset:

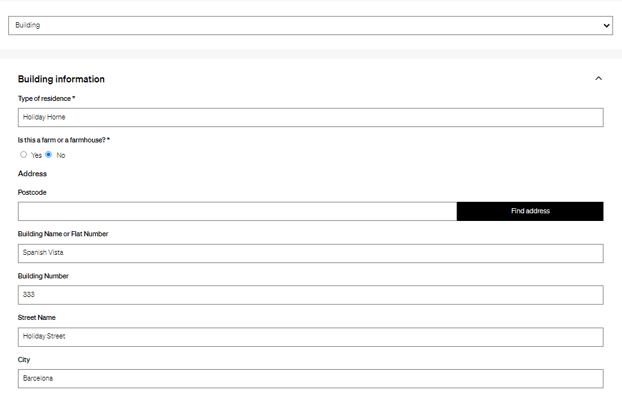

- Choose to enter the address manually (the address finder will not work for non-UK properties)

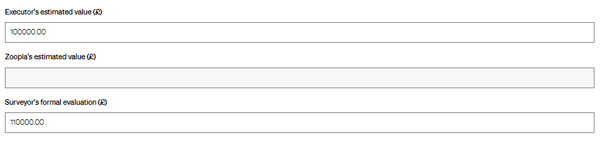

- Enter the Executor's estimated value (£) and the Surveyor's formal evaluation (£) in £ sterling (you could use a currency convertor if required)

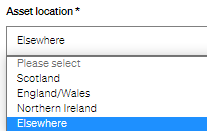

- When recording the Asset location, ensure Elsewhere is selected

❗ Ensure the Asset value is recorded in £ sterling

❗ Ensure the Asset location is recorded as Elsewhere

💡 Selecting Elsewhere as the location allows Exizent to group foreign assets together in court and inheritance tax forms

💡 All other asset tiles work the same, just select Elsewhere as the asset location for any other overseas assets

💡To add these assets into the IHT417 please see this article on generating and completing manual schedules: How do I prepare an IHT400 form and the relevant schedules?

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help.

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com