How do I edit the tax threshold on my case?

As the inheritance tax threshold can be different for each case, our tax threshold is flexible so you can edit to suit your requirements.

- Open the case you're working on - How do I find a case I'm working on?

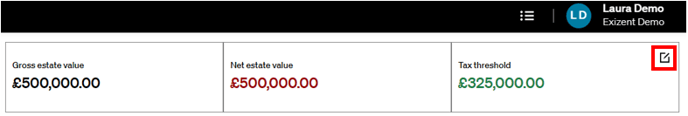

- In the top right-hand corner you will see an estate snapshot which displays the Gross estate value, Net estate value and the Tax threshold

- Click on the edit icon to the right

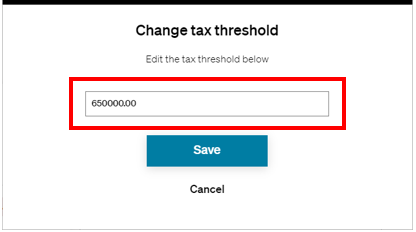

- Enter the correct inheritance tax threshold for your case and click Save

- The tax threshold value will change immediately, giving you a clear snapshot of your estate

💁 As you add assets and liabilities, you'll see the totals updating in your Gross estate and Net estate values. Find out more about how to add assets and liabilities

👍 The Net estate value will change from black to red if you exceed the tax threshold to give you an indication inheritance tax is due on your case

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com