How do I add income post-date of death?

This article will guide you through how to add and keep track of income transactions in to the estate

💁 You can view income within estate accounts summaries and outputs at the click of a button at any stage of the administration process, providing you and your clients with clear updates any time you need

⚠️ Please always remember to update the realised value of an asset after you have completed any income or expense relating to it. See here for further guidance

- Where do I add income and receipts?

- How do I add interest on the client cash account?

- How do I add income related to assets?

- How do I add a receipt?

- How do I add sums received?

- Where can I view and manage income and receipts?

- What will it look like within the estate accounts export?

Where to find income & receipts

- Open the case you wish to add income to – How do I find a case I’m working on?

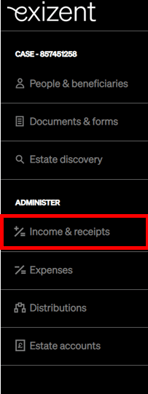

- Click Income & receipts on the left hand side menu

- Click Add new income

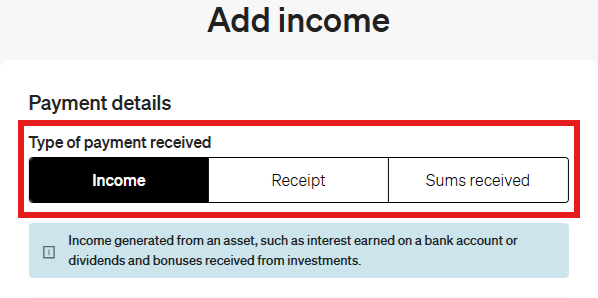

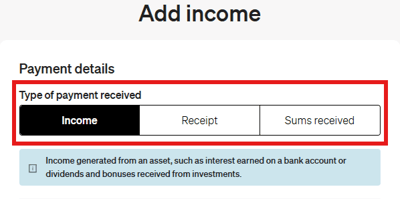

- Select what type of payment received you wish to add to the estate

Adding interest to the client cash account

This type of income allows you to add any interest accrued on the client cash account

- After clicking to add new income, choose income for the category

- Within Asset type choose Client cash account

- Once you have chosen Client cash account this will automatically update the Asset* field to Client cash account

- Enter the Full income value*

- Income source* will automatically update to Interest

- Select whether this income is taxable, and whether it is net or gross

- Enter all other relevant information and click Save

- This income will show on the Client cash account, Reconciliation and Income & receipts tabs within the estate accounts area. Where can I find this?

- The client cash account interest will also be accounted for within Distributions

- On the estate accounts exports it appears in the Income, sums received & receipts section with the description Client cash account

Income related to assets

This type of income allows you to either add income directly in to an account before it's closure or, relate income to an asset for example a vehicle and then choose where that money was deposited

- After clicking add new income, choose income for the category

- Choose the Asset type the income relates to from the dropdown menu

- A list of assets within the type of category you have chosen will appear

- Choose which item you want to relate the income to

- Enter all further relevant information

- Dependent on the asset type, the income can be sent to either:

- Client cash account

- Back in to the asset value

- Other

- Click Save

Receipt

This type of income is to show any money received into the client cash account after death

- Choose Receipt for the category

- Enter information into all relevant fields

- All receipts will show as deposited into the client cash account

- Click Save

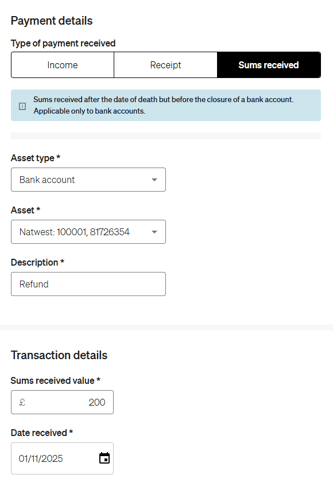

Sums received

This type of income is to show any money received after the date of death that was paid directly in to the deceased's bank account before its closure

- Choose Sums received for the category

- Choose the associated bank account from the Asset dropdown menu

- Enter information into all other relevant fields

- Click Save

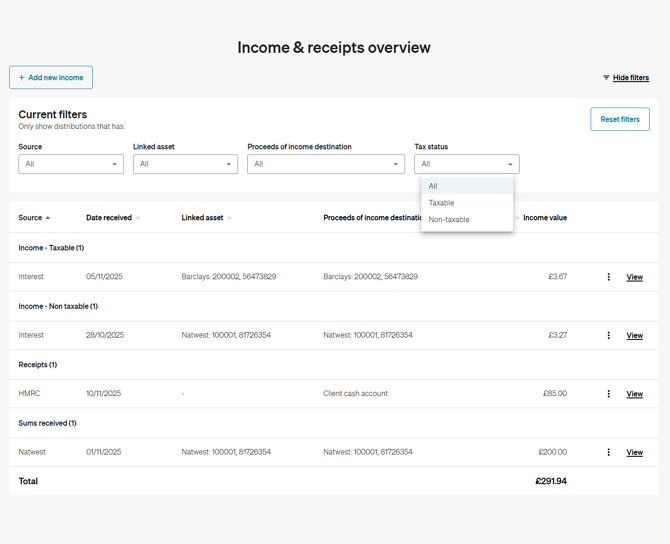

View and manage income transactions within a case

- Click the Income & receipts section on the left hand side menu:

- This will take you to an overview:

- Each income item is categorised by type, with additional filtering options available at the top of the screen.

- To edit an item click View, once open make the required changes and click Save

- To delete, click on the three dots to the right of the relevant item and choose Delete

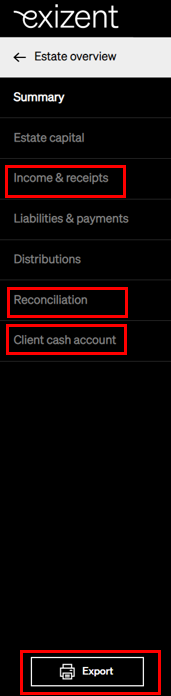

View client cash account interest, income and receipts within estate accounts summary and the estate accounts output

- Click into Estate accounts on the left hand side menu and from there you can view all estate accounts tabs

.png?width=198&name=20220110%20Estate%20accounts%20outline%20(Menu).png)

- Within Income & receipts you will see the items you have added summarised by category

- Within Reconciliation you will see a total for all income and receipts and a separate total for any income received outside the client cash account

- Within Client cash account, you will see any income deposited into client cash account

- To view the full set of accounts, click Export and choose to view in pdf or excel

✋ If the income is more than four tax years from the date of death, it will not be fit and therefore be visible within the columns on the pdf output but will be calculated within the total

👍 Any income more than four tax years from date of death will be visible on the excel output

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com