How do I prepare asset values for estate accounts?

Ready to prepare estate accounts? This article will guide you through how to finalise figures within assets

Realised Values

🎓 Definition of Realised value on the Exizent platform: The value ingathered, plus or minus any income/expense/settlements after date of death. Therefore, realised values on an asset should be entered/updated by you, the user, once you have that final value

🎓 Definition of Auto calculated realised value: System generated based on the date of death value entered by the user, plus/minus any after date of death income/expense or for any bank account(s), any settlements from the account(s) entered by the user

- Ensure all assets are added with date of death values. How do I add assets and liabilities?

- If there are income and expenses after date of death related to the asset, add these in. Here is a guide on how to add income and here is a guide on how to add expenses

- When money is received in for an asset, put the value in to the Realised value field of the related asset, add Date realised funds were received and add the Proceeds of income destination

- Below the Realised value(£) field which the user updates, you will see the system prepares an Auto calculated realised value

🤖 What will show in the Auto calculated realised value?

- Any income/expenses related to the asset

- Liabilities or expenses that have been settled from the asset

- If the value of a Money owed to the deceased asset has been paid directly in to the deceased's bank account

- The Auto calculated realised value is based on all of the estate information you have entered and should be used as a guide to ensure that what you have entered in to the Realised value field matches what the system calculates. If the Realised value you have entered does not match the Auto calculated realised value as you would expect, then there is a discrepancy to find. For example an income accidentally missed and not added to the platform

⚠️ If you add further income/expenses/settlements which affect an asset value after you have already entered a realised value, remember to go back to the asset to update

Proceeds of income destination

- If the ingathered value of an asset comes in to the client cash account, click this option

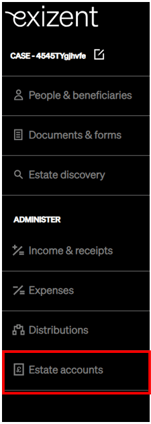

- To view this within the the estate accounts area, Click in to Estate accounts on the left hand side menu bar

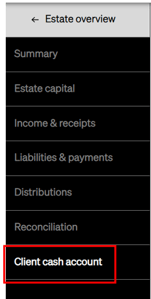

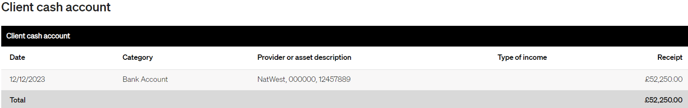

- Click Client cash account on the left hand side menu within Estate accounts where you will see the value recorded

- If the ingathered value was received somewhere else, type the destination in to the box that appears when you select Other

- To view this within the the estate accounts area, Click in to Estate accounts on the left hand side menu bar

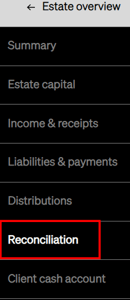

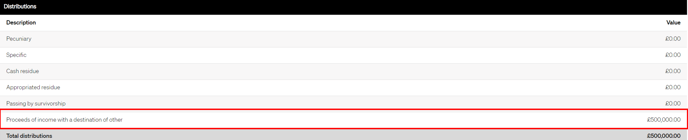

- Click Reconciliation on the left hand side menu within Estate accounts and view the value under the Distributions heading:

- Within the estate accounts outputs, you will see this detailed on the distribution sections under heading Proceeds of income with a destination of other

- You can produce a set of estate accounts on the Exizent platform in both pdf and excel at any stage, please see here for a guide on how to do this

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com