How do I add items with interest in another estate?

Find out how to add an item that has interest in another estate, how this will impact court and IHT forms and how this looks within estate accounts

Adding the asset

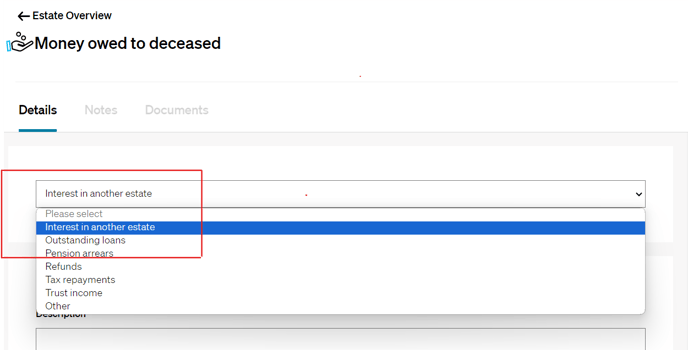

- Go to Estate Overview, add a new Money owed to deceased item

- On the next screen, choose Interest in another estate from the drop down menu

- Fill information in to the relevant fields:

- Click Save

💡If you'd like to add an item that doesn't need to be included for IHT purposes, select No for Does it form part of the estate for Inheritance Tax?(IHT)

💁 If your item is passing to a surviving owner who you have not yet added, please see here for a guide on how to add people to your case

Court and IHT forms

C1 (Scottish customers only)

- All interest in another estate items will be included within the inventory, including any items not valid for Inheritance Tax purposes

IHT205

- Jointly owned items passing to the surviving owner will populate box 9.2, section 10.4, section 12.3 and section 14

- Jointly owned items not passing to surviving owner will populate section 11.11, section 12.3 and section 14

- Solely owned items will populate section 11.11, section 12.3 and section 14

IHT404

- Jointly owned items passing to the surviving owner will populate section 6, box 8, box 10 and section 11

- Jointly owned items not passing to the surviving owner will populate section 6, box 8 and box 10

IHT400

❗ Although this will be available in future, the IHT415 is not currently pre populated, therefore solely owned items will need to be manually updated on to this schedule. Please see here for a guide including information on how to produce manual forms

- Values from the IHT404 will be populated in to relevant areas of the IHT400

Estate accounts

- You are able to add income and expenses to any item with interest in another estate. Find out more about how to add income and expenses

- You are also able to distribute the item. Find out more about how to add distributions

- If the interest in another estate item forms part of the estate for IHT, it will be visible in the estate accounts section within estate capital and will appear in the estate accounts outputs grouped together within Money owed to deceased:

👷 Our team are regularly making improvements and adding new features. Some things may have changed since this guide was written as functionality gets even more fabulous. If you need further assistance, please contact the Customer Success team who are always happy to help

🖥️ Chat to us through the knowledge base - click the chat icon in the bottom right corner of this page

☎️ Call us on 020 8152 2902

✉️ Email us on support@legal.exizent.com